This site best viewed at 1366 px x 768 px using the latest Firefox, IE, Chrome, Safari versions.

- AUM is the value of assets managed by a company for its customers

- As on 31st March 2024, AUM is Rs. 2,92,220 crore. Data is as per HDFC life Integrated Annual Report FY 2023 - 2024.

- Individual death claim settelement ratio by number of policies as per audited annual statistics for 2023-24

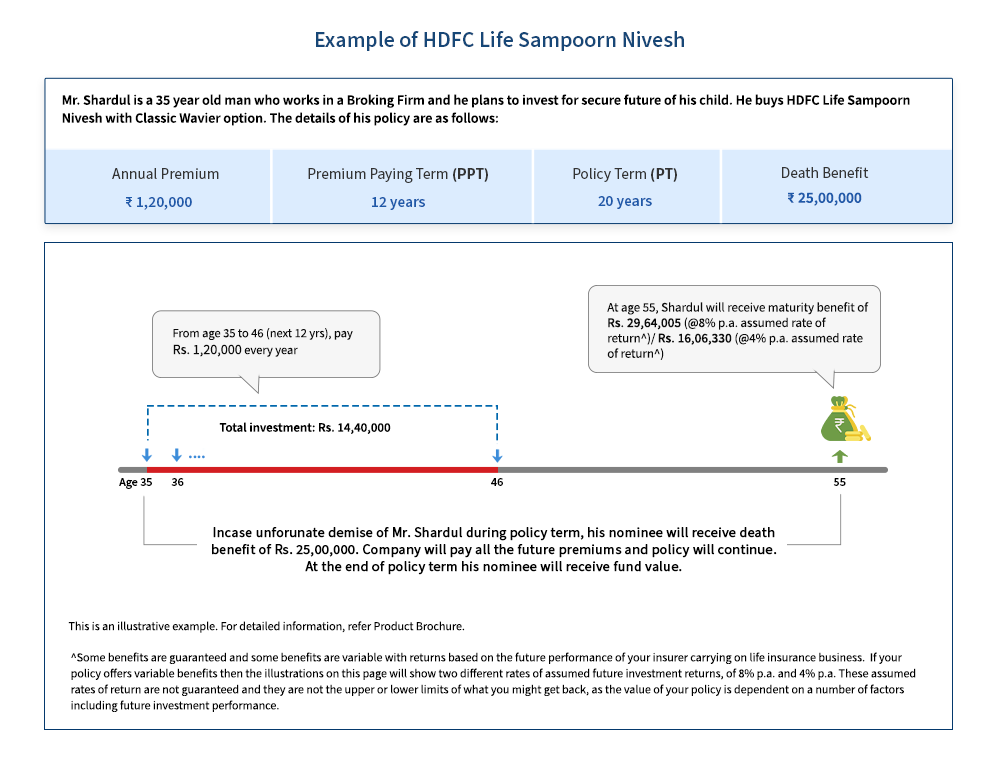

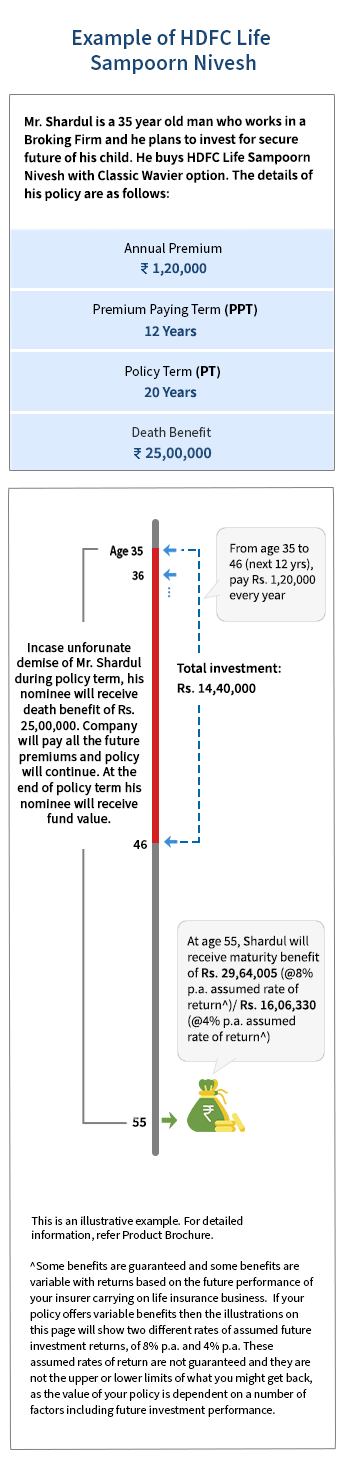

In this policy, the investment risk in the investment portfolio is borne by the policyholder. The Linked Insurance products do not offer any liquidity during the first five years of the contract. The policyholders will not be able to surrender/withdraw the monies invested in Linked Insurance Products completely or partially till the end of fifth year

HDFC Life Insurance Company Limited.CIN No.L65110MH2000PLC128245. IRDAI Regn. No. 101 .The name/letter 'HDFC' in the name/logo of HDFC Life Insurance Company Limited (HDFC Life) belongs to HDFC Bank Limited and is used by HDFC Life under license from HDFC Bank Limited.

Registered Office: 13th Floor, Lodha Excelus, Apollo Mills Compound, N.M. Joshi Marg, Mahalaxmi, Mumbai 400 011. For purchasing a new policy, you can Email us on buyonline@hdfclife.in and call us on 1800-266-9777 (All days, from 9 am to 9pm). For in-progress applications (post payment), you can email us on onlinequery@hdfclife.in and call us on 1800-266-0315 (All days, from 10 am to 7 pm). Website:www.hdfclife.com.

Unit Linked Insurance products are different from the traditional insurance products and are subject to the risk factors. The premium paid in Unit Linked Insurance policies are subject to investment risks associated with capital markets and the NAVs of the units may go up or down based on the performance of fund and factors influencing the capital market and the insured is responsible for his/her decisions. HDFC Life Insurance Company Limited is only the name of the Life Insurance Company and HDFC Life Sampoorn Nivesh Plus (UIN No: 101L180V01) is a Unit Linked Non Participating Life Insurance Plan, is only the name of the unit linked insurance contract and does not in any way indicate the quality of the contract, its future prospects or returns. HDFC Life Income Benefit on Accidental Disability Rider (UIN: 101A038V01), HDFC Life Health Plus Rider (UIN: 101A034V01), HDFC Life Waiver of Premium Rider (UIN: 101A035V01), HDFC Life Protect Plus Rider (UIN: 101A037V01) and HDFC Life LiveWell Rider (UIN: 101A036V01) are the names of the riders are the names of the riders. Please know the associated risks and the applicable charges, from your Insurance agent or the Intermediary or policy document issued by the insurance company. The various funds offered under this contact are the names of the funds and do not in any way indicate the quality of these plans, their future prospects and returns. Life Insurance Coverage is available in this product. For more details on risk factors, associated terms and conditions and exclusions please read sales brochure carefully before concluding a sale.ARN: ED/02/25/21740

BEWARE OF SPURIOUS PHONE CALLS AND FICTITIOUS/FRAUDULENT OFFERS

- IRDAI is not involved in activities like selling insurance policies, announcing bonus or investment of premiums. Public receiving such phone calls are requested to lodge a police complaint.