This site best viewed at 1366 px x 768 px using the latest Firefox, IE, Chrome, Safari versions.

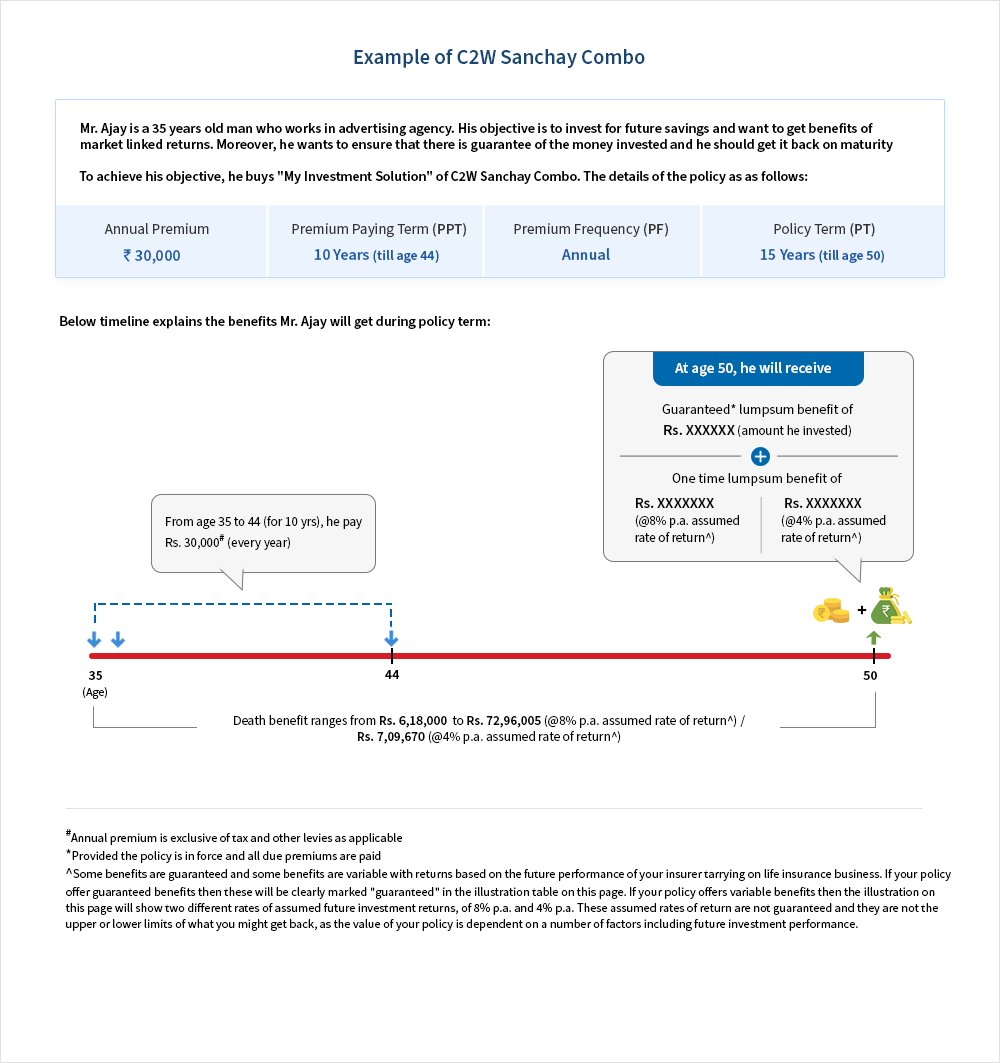

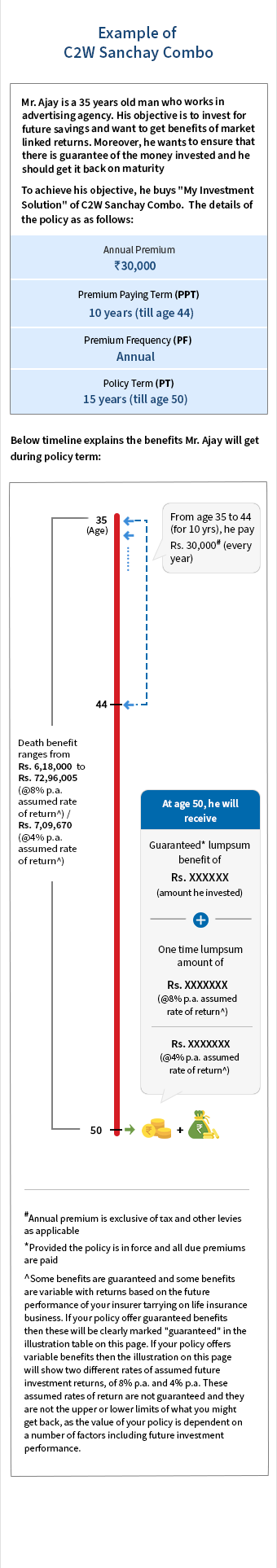

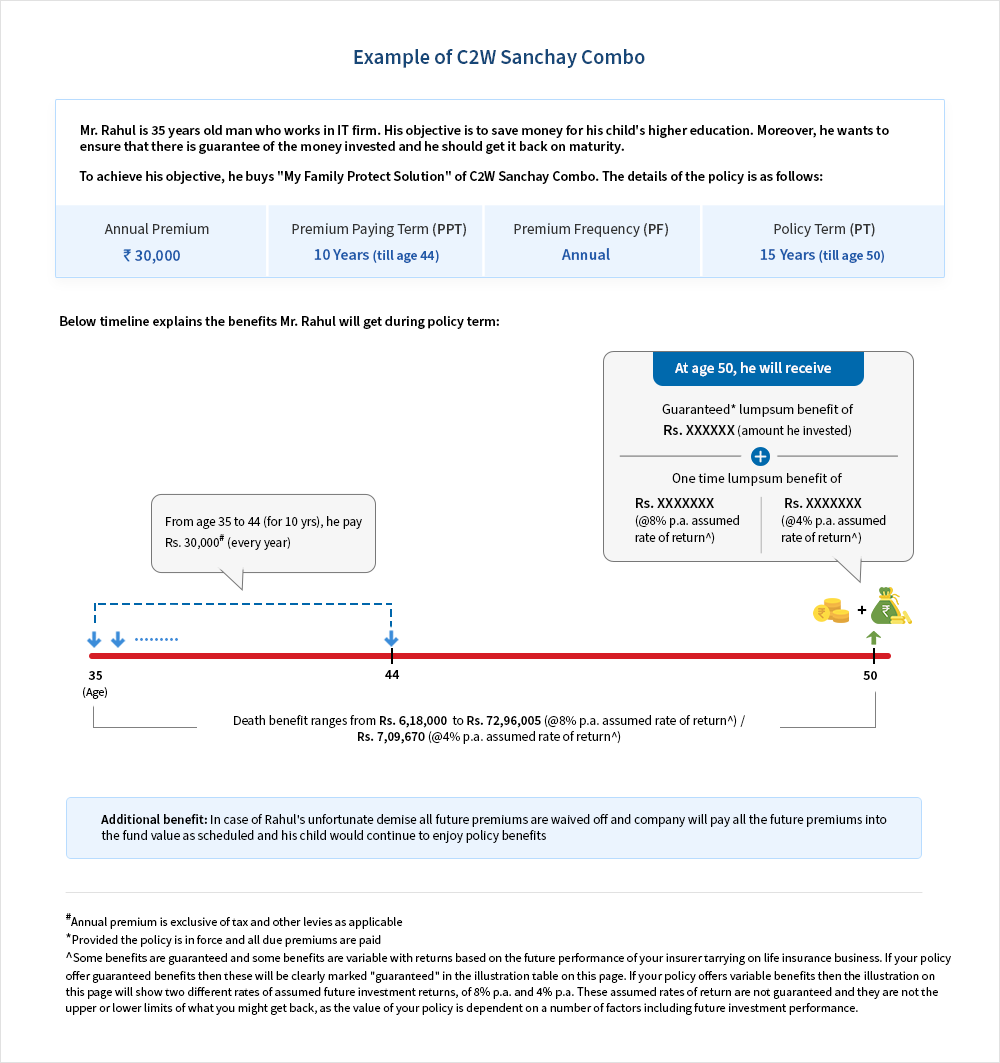

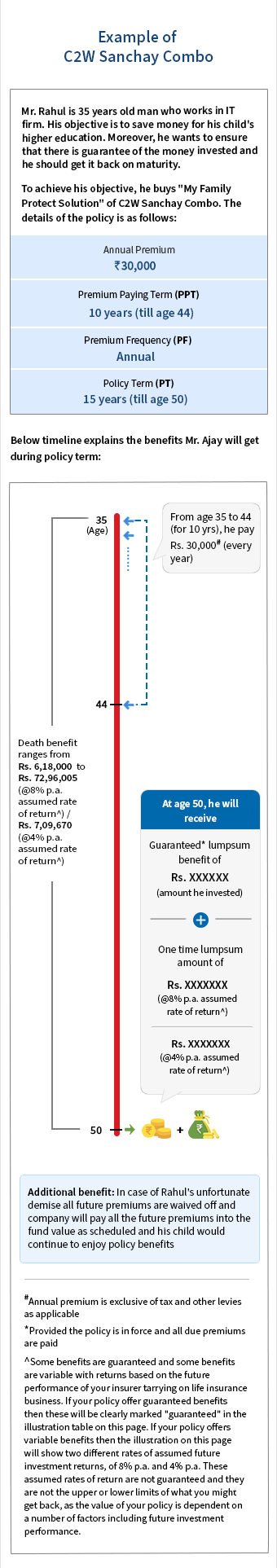

- Provided the policy is in-force and all due premiums have been paid. On survival, at end of policy term, you will receive lump sum benefit equal to aggregate of Sum Assured on Maturity and Accrued Guaranteed Additions. This feature is available under product named HDFC Life Sanchay

- These are non-guaranteed returns available under product named HDFC Life Click 2 Invest and will be given provided the policy is in-force and all due premiums have been paid.

- Tax Benefits as per the applicable sections of the Income Tax Act, 1961,. Tax benefits are subject to changes in tax laws.

- AUM is the value of assets managed by a company for its customers.

- As on 31st March 2024, AUM is Rs. 2,92,220 crore. Data is as per HDFC life Integrated Annual Report FY 2023 - 2024.

- Individual death claim settelement ratio by number of policies as per audited annual statistics for 2023-24.

- The Average claim settlement time is calculated as time period from the day all necessary documents are submitted to the company till cheque/NEFT payment is initiated.

In this policy, the investment risk in the investment portfolio is borne by the policyholder. The Linked Insurance products do not offer any liquidity during the first five years of the contract. The policyholders will not be able to surrender/withdraw the monies invested in Linked Insurance Products completely or partially till the end of fifth year.

HDFC Life Insurance Company Limited ("HDFC Life"). CIN: L65110MH2000PLC128245,IRDAI Reg. No. 101

Read More